Health Insurance Coverage Tax Penalty . find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. If you live in a state that requires you to have health coverage. this means you don’t need an exemption in order to avoid the penalty. you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,.

from askariana.com

you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. If you live in a state that requires you to have health coverage. this means you don’t need an exemption in order to avoid the penalty.

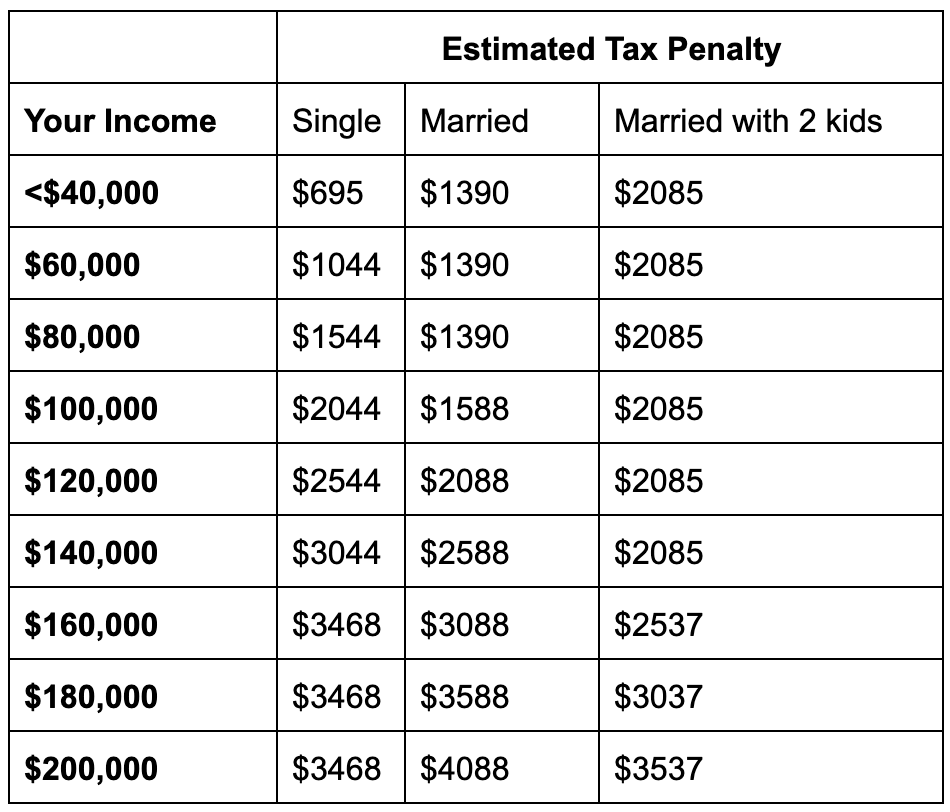

2020 California health insurance tax penalty How much will you owe

Health Insurance Coverage Tax Penalty obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. If you live in a state that requires you to have health coverage. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. this means you don’t need an exemption in order to avoid the penalty. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax.

From individuals.healthreformquotes.com

Mandate Individual Health Insurance Tax Penalty California Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. If you live in a state that requires you. Health Insurance Coverage Tax Penalty.

From www.youtube.com

Health Insurance Penalty was it repealed or not? In what states there Health Insurance Coverage Tax Penalty if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. If you live in a state that requires you to have health coverage. for tax years between. Health Insurance Coverage Tax Penalty.

From www.neebco.com

Health Plan Penalties Increase New England Employee Benefits Company Health Insurance Coverage Tax Penalty for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. obamacare tax penalties were federal penalties that you’d have to pay. Health Insurance Coverage Tax Penalty.

From www.peoplekeep.com

Flow Chart Employer's Guide to Health Insurance Tax Penalties Health Insurance Coverage Tax Penalty if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. this means you don’t need an exemption in order to avoid the penalty. for tax years. Health Insurance Coverage Tax Penalty.

From www.tffn.net

Tax Penalty for Not Having Health Insurance What You Need to Know Health Insurance Coverage Tax Penalty for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. this means you don’t need an exemption in order to avoid the penalty. you pay the health premium if you are a resident of ontario and your employment or pension income. Health Insurance Coverage Tax Penalty.

From www.thirdway.org

The Tax Penalties and Bureaucratic Burden of Domestic Partner Health Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. obamacare tax penalties were federal penalties that you’d have to pay at tax time. Health Insurance Coverage Tax Penalty.

From www.researchgate.net

Subsidies and tax penalties under the Private Health Insurance Health Insurance Coverage Tax Penalty If you live in a state that requires you to have health coverage. this means you don’t need an exemption in order to avoid the penalty. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. obamacare tax penalties were federal penalties that you’d have to pay at. Health Insurance Coverage Tax Penalty.

From www.healthinsurance.org

Will you owe a penalty under Obamacare? Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. this means you don’t need an exemption in. Health Insurance Coverage Tax Penalty.

From hub.universalhealthct.org

Am I Eligible for an Exemption Under the Affordable Care Act Health Insurance Coverage Tax Penalty obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. this means you don’t need an exemption in order to avoid the penalty. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. If you live in a. Health Insurance Coverage Tax Penalty.

From enrollca.com

Tax Penalty for Not Having Health Insurance Coverage EnrollCA Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. If you live in a state that requires you to have health coverage. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. for tax. Health Insurance Coverage Tax Penalty.

From www.templateroller.com

2022 Rhode Island Shared Responsibility Worksheet Individual Health Health Insurance Coverage Tax Penalty obamacare tax penalties were federal penalties that you’d have to pay at tax time if you didn’t have health insurance. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. this means you don’t need an exemption in order to avoid the penalty. for tax years. Health Insurance Coverage Tax Penalty.

From www.youtube.com

Carelifornia Tax Penalty for NOT Having Health Insurance YouTube Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. this means you don’t need an exemption in order to avoid the penalty. for. Health Insurance Coverage Tax Penalty.

From theinsurancenerd.com

Health Insurance Penalty A Guide Of What It Involves And How To Avoid It Health Insurance Coverage Tax Penalty for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. this means you don’t need an exemption in. Health Insurance Coverage Tax Penalty.

From solidhealthinsurance.com

Tax Penalty for Not Having Health Insurance Solid Health Insurance Health Insurance Coverage Tax Penalty if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. If you live in a state that requires you to have health coverage. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without. Health Insurance Coverage Tax Penalty.

From www.nber.org

Informational Letters About Tax Penalties for Underinsurance Raised Health Insurance Coverage Tax Penalty find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. for tax years between 2014 and 2018, if you qualify for health insurance and don’t meet the exemption requirements, but still choose to remain without coverage,. you pay the health premium if you are a resident of ontario. Health Insurance Coverage Tax Penalty.

From www.businessinsurance.com

More than 10 million enroll in health coverage, avoiding tax penalty Health Insurance Coverage Tax Penalty you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. for tax years between 2014 and 2018, if you qualify for health insurance and. Health Insurance Coverage Tax Penalty.

From www.bigstridz.com

The Different Types of Health Insurance This is What You Need to Know Health Insurance Coverage Tax Penalty if you pay premiums for a private health insurance plan, you may be eligible for a credit against your taxes. you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. find health care tax forms and information on the individual shared responsibility provision, exemptions,. Health Insurance Coverage Tax Penalty.

From insuremekevin.com

California Penalty For Not Having Health Insurance Health Insurance Coverage Tax Penalty find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. you pay the health premium if you are a resident of ontario and your employment or pension income is more than $20,000 a. if you pay premiums for a private health insurance plan, you may be eligible for. Health Insurance Coverage Tax Penalty.